Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold fluctuations are still weak! Rebound and wait for nothing!

- A collection of positive and negative news that affects the foreign exchange mar

- The US dollar/JPY tends to rise, and the trend is subject to the Fed's expectati

- UK PMI and inflation data push pound stronger than expected, while euro maintain

- Gold fluctuates gradually and continues to rise above 3356 tonight

market analysis

The 3300 is close to the turning point of long and short position. According to the video, the bulls will be reversed.

Wonderful introduction:

A clean and honest man is the happiness of honest people, a prosperous business is the happiness of businessmen, a punishment of evil and traitors is the happiness of chivalrous men, a good character and academic performance is the happiness of students, aiding the poor and helping the poor is the happiness of good people, and planting in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Market Analysis]: The 3300 is close to the turning point of long and short, and according to the video, the long will be reversed." Hope it will be helpful to you! The original content is as follows:

Zheng's silver point: 3300 is close to the turning point of long and short. According to the video, the bulls are about to make up for the long and short

I went out today and just rushed home. It was a bit late, so I won't interpret it in detail. I will say a few words in a short time.

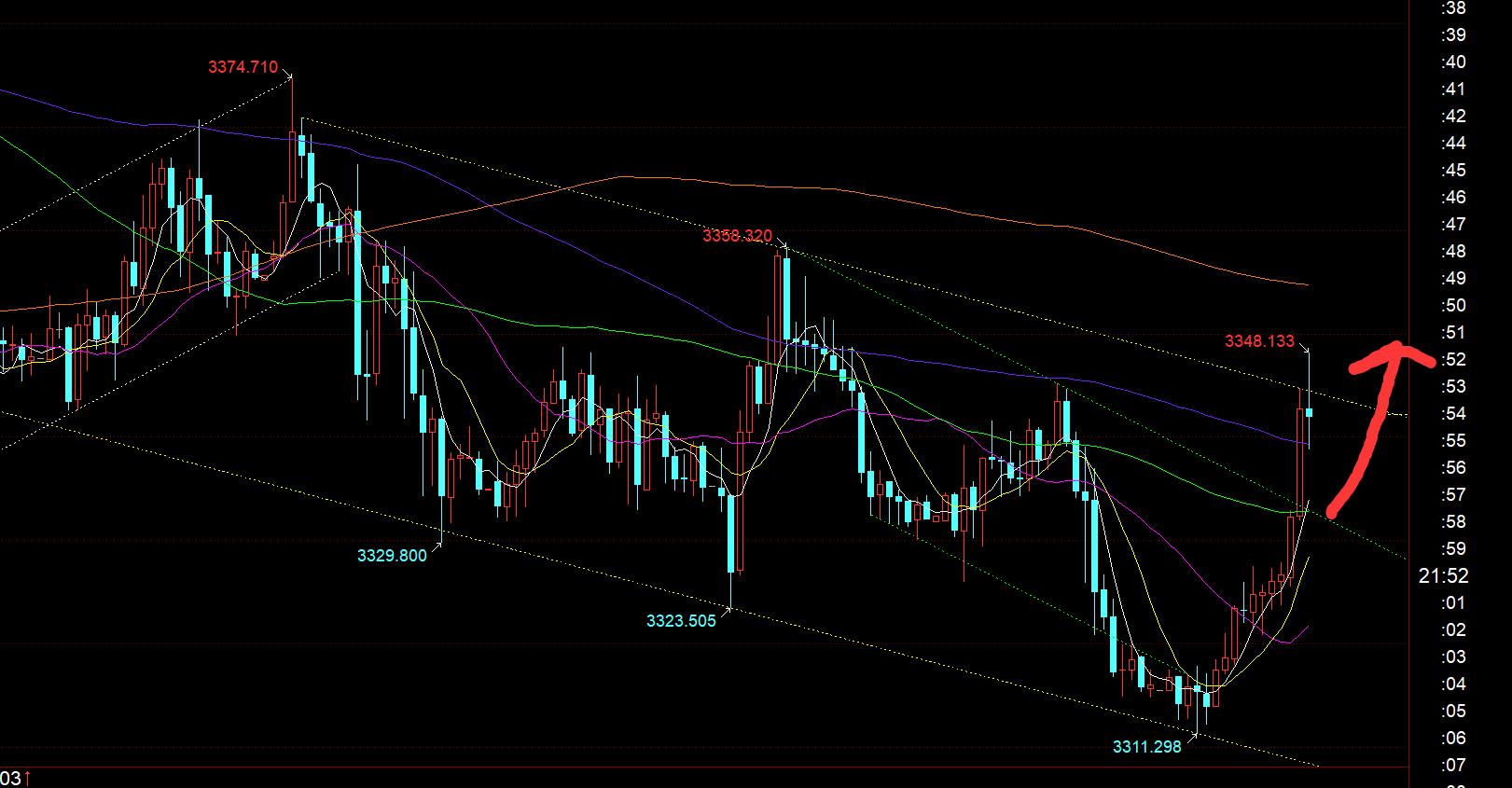

For yesterday's market, as long as gold falls sharply in the morning, it is usually a time to test the overnight low point or puncture, and it is a decisive opportunity to decisively lower the long point; before the night before, it was also emphasized in advance that 3330, 3322, etc. are still supported, and when they touch it, they can continue to be bullish. Yesterday morning, it first fell sharply and punctured 3330, and then immediately rebounded to 3330, which is a low-bang signal, but unfortunately the strength is poor, and the highest is only given to 3345; the US market is suppressed again and washed up, regardless of whether the European market is weak or strong, it is a daytime fluctuation. , and then break the new low at night, and then continue to fall sharply the next morning, and then continue to rise;

So after piercing the overnight low of 3315 this morning, it is a good position for low longs near 3310. 3310 is the lower trend support point of the new convergence triangle of the daily line 3120 and 3267. At the same time, it has been emphasized for two consecutive weeks that you can prepare for the bottom of 3300, because the weekly middle line and the monthly line 5 moving averages are both moving upward and resonating at the 3300 line, and short-term strength and weakness can occur at any time, turning to a long upward attack;

So sure enough, today's 3311 is bullish, which is in line with the prediction again. The morning prompts to look bullish first. The short-term resistance gives 3332-35, which is the 618-divided position of yesterday's decline; but today's trend, the hourly line has been rising continuously, with signs of VIt appeared, and the big positive closed at 3332 resistance level at 20 o'clock, so I immediately reminded not to be bearish. It is possible that it will really maintain a small one-sided side today, unlike Monday, which is a small one-sided side during the day and a return to its original shape at night. Because the difference is that on Monday, the European session was suppressed and they are all negative lines, while today the European session is all positive lines, and it continues to break the highs. Now test the 3345 position. Once the break through the station, be more cautious when you lose the short position, then 3311 will most likely become a new short-term bottom. You can attack all the way up to 3390 and 3400, etc., which is also in line with the idea of selling the bottom above 3300;

Of course After breaking through 3345, there are some early pressures of 3358-60 and 3371-75 above, but at that time the trend has gradually become stronger, and the pressure is generally only a brief fall, and then it will continue to break through and attack to 3390-3400 and above;

The current operation above 3333 is maintaining bullish, with resistance of 3345-48. If you break through again, pay attention to 3358-60, etc.; you can try to observe the trend tonight, as long as you can no longer suppress and wash back tonight, and the daily line closes above the 5th day, then you can follow the bullish all the way from tomorrow, and the turning point is confirmed, and wait more One night, no hurry;

Silver: This morning, it is prompted to look bullish at 618 at around 37.16. Although it pierced a little during the day, the final direction is no problem. It is to hit the bottom and counterattack, and it also reaches the expected target resistance of 37.8. Next, it is a question of whether 37.8-37.9 can be re-established. The support is to continue to be bullish at 37.2.

The above are several points of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by the market watching and reviewing for more than 12 hours a day in the past twelve years. The technical points will be disclosed every day, in line with the text. Interpretation with video, friends who want to learn can xmniubi.compare and refer to the actual trends; those who recognize ideas can refer to the operation, lead the defense well, risk control first; those who do not agree should just be over; thank everyone for their support and attention; [The views of the article are for reference only, investment is risky, and you need to be cautious when entering the market, operate with rational operation, strictly set losses, control positions, risk control first, and bear the profit and loss at your own risk]

Contributor: Zheng's Dianyin

Watch the market for more than 12 hours a day, and persist for ten years. Detailed technical interpretation is made public on the entire network, and serve the wholeheartedly, with sincerity, sincerity, perseverance and wholeheartedly! xmniubi.comments written on major financial websites! Proficient in the K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Market Analysis]: 3300 is close to the turning point of long and short, interpret according to the video, and the longs are reversed" is carefully xmniubi.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibilityLet’s make our life today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here