Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The dollar index is weak, the market is waiting for Powell to speak

- The dollar index is competing for long and short, CPI and Jackson Hall meeting a

- The game of life and death at the 172 mark in the European and Japanese exchange

- Practical foreign exchange strategy on July 21

- A collection of positive and negative news that affects the foreign exchange mar

market news

The long-legged spindle makes a range, and gold and silver continue to consolidate this week

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM official website]: Long spindle makes range, gold and silver extend consolidation this week". Hope this helps you! The original content is as follows:

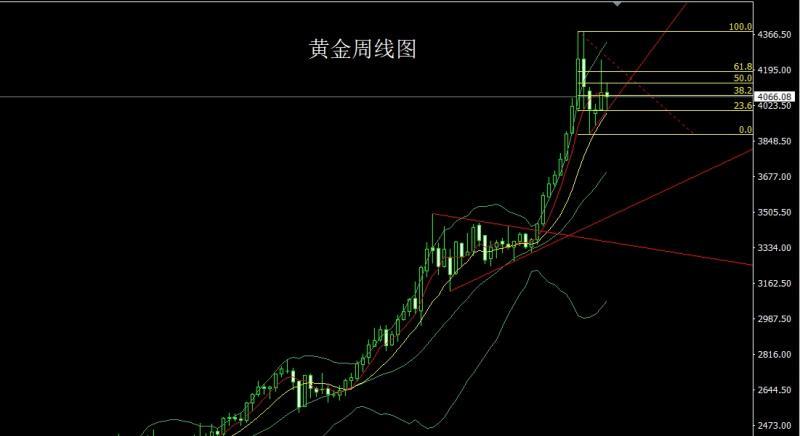

Last week, the gold market opened at the beginning of the week at 4086.5, and then the market fell back first. The weekly minimum reached 3997.2, and then the market rose strongly. The weekly maximum touched 4133, and then the market fluctuated in a range. After the weekly line finally closed at 4065.8, the weekly line started with a spindle with a lower shadow line slightly longer than the upper shadow line. The form closes, and after the end of this form, the longs of 3325 and 3322 below and the longs of 3368-3370 last week and the longs of 3377 and 3385 and 3563 will be followed up with a stop loss of 3750. In early trading today, it first fell back to 4035 and a stop loss of 4029. The target is 4050 and 4062 and 4075-4080 pressure.

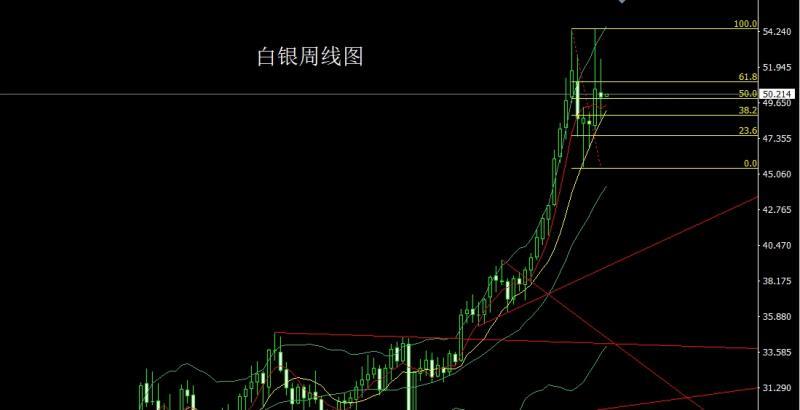

The silver market opened low last week at 50.323, then the market retreated slightly to reach 49.17, and then the market rose strongly. The weekly highest touched 52.476, and then the market fell strongly due to fundamental pressure. The weekly lowest reached 48.577, and then rose in late trading. After finally closing at 50.018, the weekly line closed in the form of a long-legged cross star with the upper shadow line longer than the lower shadow line. After the xmniubi.completion of this form, the longs of 37.8 and 38.8 below followed up and held at 42. In the early trading, 50.7 was first pulled up and the short stop was 50.9. The target was 50.3 and 50. If it fell below, 49.6And 49.3 is more prepared to leave the field.

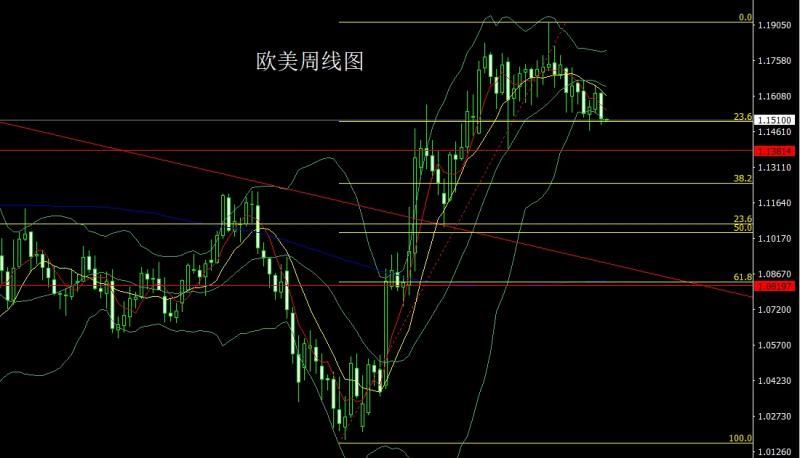

European and American markets opened at 1.16200 last week, and then the market rose slightly to reach 1.16249, and then the market fluctuated and fell back. The weekly minimum was at 1.14900 and then consolidated. After the weekly line finally closed at 1.15152, the weekly line closed with a big negative line with a slightly longer lower shadow. After this form ended, the weekly line Yin and yang, this week it will go high first. In terms of points, last week's short position at 1.16050 and yesterday's short position at 1.15950 were reduced, and then the stop loss was followed up at 1.15800. Today, the first pull is given. 1.15500 short stop loss 1.15700, target 1.15300 and 1.15000 and 114800 and 1.14600.

The U.S. crude oil market opened low at 59.63 last week, then the market first rose to a position of 60.99, and then the market fluctuated strongly and fell back. The weekly minimum reached a position of 57.45, and then consolidated in late trading, and the weekly line finally closed at 58.0 After the position of 9, the weekly line closes with a big negative line with the upper shadow line longer than the lower shadow line. After the end of this form, the 59 short stop loss is 59.5 this week. The target is 58.5, 58 and 57.5, and if it falls below, 57-56.6.

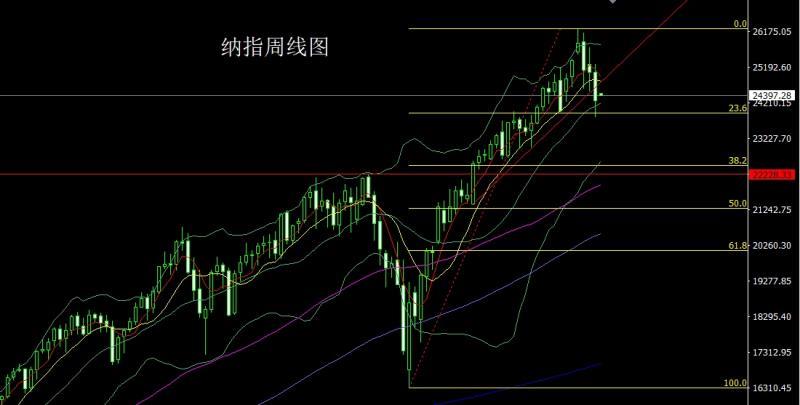

After the Nasdaq market opened at 25046.17, the market first rose to reach a weekly high of 25280.74 and then fell back. The weekly low reached a position of 23817.78 and then consolidated in late trading. The weekly line finally closed at 24 After the position of 271.48, the weekly line closes with a big negative line with a lower shadow line longer than the upper shadow line. After this form ends, this week 24200 short long stop loss is 24140, and the target is 24400 and 24500-24600 to leave the market and prepare to go short.

Fundamentals, last week’s fundamentals, the minutes of the Federal Reserve’s October meeting released last week revealed the fierce internal debate on whether to cut interest rates in December. Thursday's September non-farm payroll data, which was significantly better than expected, may make the situation more xmniubi.complicated. After a series of official speeches on Friday, traders in the interest rate futures market increased their expectations for the probability of a rate cut by the Federal Reserve in December to over 70%, almost double from less than 40% after the non-farm payrolls. The minutes noted that "many" officials believed there was a lack of sufficient justification for a rate cut in December, outnumbering "several" officials who believed a rate cut was "probably appropriate." However, most officials believe further interest rate cuts are still necessary in the future. Japanese Prime Minister Sanae Takaichi held his first bilateral meeting with Bank of Japan Governor Kazuo Ueda. Ueda Kazuo said the Bank of Japan is gradually adjusting its currencyThe intensity of easing policy implies that interest rates will continue to be raised cautiously. He pointed out that the mechanism of simultaneous growth of inflation and wages is being restored, and the central bank will make appropriate policy decisions based on data and will announce the next stage of policy decisions on December 19. The US media disclosed the 28-point Ukraine peace plan proposed by the US presidential team. The plan involves territorial, military and diplomatic aspects, requiring Ukraine to give up more territory in the east, limit the size of its army to 600,000, and agree never to join NATO. In addition, the plan also requires NATO not to station troops in Ukraine, and Ukraine needs to specify in its constitution a clause not to join NATO. On the economic front, the plan proposes that some frozen Russian assets will be used for the reconstruction of Ukraine, while sanctions against Russia will be gradually lifted. The United States and Russia will also carry out long-term cooperation in fields such as AI and mining, and Russia will be invited to return to the G8. In addition, the plan also involves humanitarian arrangements, including prisoner exchanges, civilian return and family reunification plans. This week's fundamentals will focus on the US November Dallas Fed Business Activity Index at 23:30 on Monday. On Tuesday, focus on the U.S. September retail sales monthly rate and the U.S. September PPI annual rate at 21:30. Then look at the monthly rate of the FHFA house price index in the United States at 22:00 in September and the annual rate of the S&P/CS non-seasonally adjusted house price index in 20 major cities in the United States in September. Later, we will look at the monthly rate of U.S. xmniubi.commercial inventories in August at 23:00, the monthly rate of the U.S. existing home contracted sales index in October, the U.S. Conference Board Consumer Confidence Index in November, and the U.S. Richmond Fed Manufacturing Index in November. On Wednesday, focus on the number of initial jobless claims in the United States at 21:30 for the week to November 22 and the monthly rate of U.S. durable goods orders in September. Later, look at the U.S. November Chicago PMI at 22:45 and the annualized total number of U.S. new home sales in September at 23:00. Later at 23:30, the U.S. EIA crude oil inventory for the week to November 21, the U.S. EIA Oklahoma Cushing crude oil inventory for the week to November 21, and the U.S. EIA strategic petroleum reserve inventory for the week to November 21. Watch for the Federal Reserve's Beige Book of Economic Conditions to be released at 3:00 a.m. on Thursday. The U.S. market will be closed for Thanksgiving on the same day. The market will be closed on Thanksgiving Day on Friday.

In terms of operation, gold: The longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377, 3385, and the longs of 3563 will be followed up at 3750 after reducing positions. In early trading today, it will first fall back to 4035 and stop loss 4029. The target is 4050, 4062, and 4075-4080 pressure.

Silver: The longs of 37.8 and 38.8 below will follow up and hold at 42. In the early trading, it will first pull up 50.7 and short the stop loss 50.9. The target is 50.3 and 50. If it falls below, look at 49.6 and 49.3 and prepare to leave the market.

Europe and the United States: Last week’s short position at 1.16050 and yesterday’s short position at 1.15950 were reduced, and the stop loss was followed up at 1.15800. Today, it first pulled up and gave a short stop loss of 1.15500 and 1.15700. The target is 1.15300, 1.15000, and 114800.1.14600.

U.S. crude oil: 59 short stop loss 59.5 this week, target 58.5, 58 and 57.5, if below 57-56.6.

Nasdaq: 24200 short stop loss 24140 this week, target 24400 and 24500-24600 to leave the market and prepare to go short.

The above content is all about "[XM official website]: Long spindle makes range, gold and silver extend consolidation this week". It is carefully xmniubi.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here