Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Powell's dovish signal triggers a frenzy of interest rate cuts, and the US dolla

- There is no progress in tariffs between China and the United States, and gold re

- Australian dollar continues to rise after strong wage growth

- Gold is now priced at 3372 in the morning!

- Powell's hawkish statements cannot hide the dovish turn. Will September repeat t

market news

Thanksgiving Day is approaching on Thursday, and the New York Stock Exchange, CME, and ICE are closed.

Wonderful introduction:

Since ancient times, there have been joys and sorrows of parting, and since ancient times, there have been sad songs about the moon. It’s just that we never understood it and thought everything was just a distant memory. Because without real experience, there is no deep inner feeling.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: Thanksgiving Day is approaching on Thursday, and the New York Stock Exchange, CME, and ICE are closed." Hope this helps you! The original content is as follows:

XM Forex Market Preview: Thanksgiving Day is approaching on Thursday, and the New York Stock Exchange, CME, and ICE are closed.

▲XM Chart

This Thursday the United States will usher in Thanksgiving, an important national holiday, and the next day is the Black Friday shopping day. All major U.S. exchanges have issued holiday closure announcements. The New York Stock Exchange announced that it will be closed for one day on Thanksgiving Day; the market will be closed on Black Friday at 02:00 Beijing time on the 29th, xmniubi.compared with the original closing time of 05:00 Beijing time. The Chicago Mercantile Exchange CME announced that on Thanksgiving Day, its U.S. Treasury futures contract trading will be closed for one day; its precious metals and U.S. crude oil futures contract trading will end at 03:30 Beijing time on the 28th, and stock index futures contract trading will end at 02:00 Beijing time on the 28th. The original closing time for both is 06:00 Beijing time. On Black Friday, the trading of its U.S. bond futures contract ended at 03:30 Beijing time on the 29th, the trading of its precious metal, U.S. crude oil, and foreign exchange futures contracts ended at 03:45 Beijing time on the 29th, and the trading of the stock index futures contract ended at 02:15 Beijing time on the 29th. Intercontinental Exchange ICE announced that on Thanksgiving Day, its Brent crude oil futures contract trading will end at 02:30 Beijing time on the 28th, and the original closing time will be 05:00 Beijing time.. On Black Friday, trading in its Brent crude oil futures contract ended early at 04:00 Beijing time on the 29th.

▲XM chart

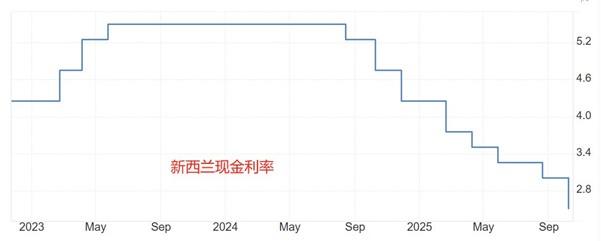

At 9:00 this Wednesday, the Federal Reserve Bank of New Zealand will announce the results of the November interest rate decision. Mainstream expectations are that the Federal Reserve Bank of New Zealand will cut interest rates by 25 basis points, and the official cash rate will drop from 2.5% to 2.25%. Since August 2024, the New Zealand Federal Reserve has cut interest rates 8 times, with a cumulative rate of 300 basis points, which is much higher than the 150 basis points cut by the Federal Reserve. Market participants are deeply divided on whether the Federal Reserve will cut interest rates in December, but they are very unanimous in their expectations that the New Zealand Federal Reserve will cut interest rates in November, which will drive the New Zealand dollar to continue to depreciate against the US dollar. From the perspective of inflation rate, in the third quarter of this year, New Zealand's CPI annual rate reached 3%, which was higher than the previous value of 2.7%, rising for three consecutive quarters. Rising inflation requires the Reserve Bank of New Zealand to be restrictive in interest rates and not cut interest rates excessively. However, the poor performance of the job market forced the Reserve Bank of New Zealand to cut interest rates. In the third quarter of this year, New Zealand's unemployment rate reached 5.3%, the highest level since 2017. Faced with labor market pressure, the Reserve Bank of New Zealand will continue to cut interest rates even if inflation is relatively high.

▲XM Chart

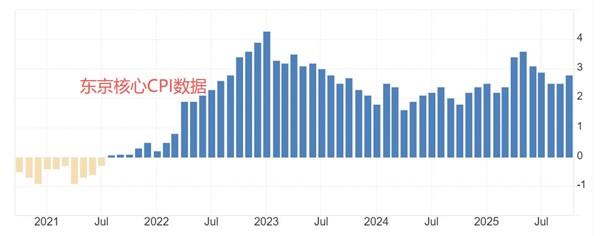

At 7:30 this Friday, the Statistics Bureau of the Ministry of Internal Affairs and xmniubi.communications of Japan will announce the annual core CPI rate in Tokyo in November, with the previous value of 2.8% and the expected value of 2.7%. At the same time, Japan's October unemployment rate data will also be released, with the previous value being 2.6% and the expected value being 2.5%. Japan's unemployment rate data is extremely stable and remains below the 5% full employment standard all year round. Therefore, market participants pay relatively little attention to the unemployment rate data and focus on the inflation rate data. Tokyo's CPI data is released earlier than the national CPI data, and Tokyo's economic data has guiding significance for Japan's national data, so this data has received major attention from market participants. According to historical data, Tokyo's core CPI has turned from negative to positive since August 2021, reaching a stage high of 4.3% in January 2023. To this day, it has not continued to fall below the moderate inflation standard of 2%. Tokyo's inflation rate is already very stable, and the possibility of another deflation or hyperinflation is low. For the Bank of Japan, in the face of stable prices and extremely low unemployment, it continues to normalize the low base interest rate, that is, to continuously raise interest rates. If Tokyo CPI data performs well, expectations for the Bank of Japan to raise interest rates will continue to rise, and the value of the Japanese yen will receive a certain boost.

XM risk warning, disclaimer, special statement: The market is risky, so investment needs to be cautious. The above content only represents the personal views of analysts and does not constitute any operational advice. Please do not rely on this report as your sole reference. Are you there?During the same period, analysts' opinions may change and updates will be made without further notice.

The above content is all about "[XM Foreign Exchange Market Analysis]: Thanksgiving Day is approaching on Thursday, the New York Stock Exchange, CME, and ICE are closed". It is carefully xmniubi.compiled and edited by the XM Foreign Exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here