Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- USD/Yen runs out of power near July highs

- 7.28 Gold jumps low, shorter and shorter

- Will the September Fed resolution be a turning point for the New York dollar/dol

- OPEC+ raided up demand forecast, fierce competition between long and short facto

- France's political turmoil and Bank of England's position supports the pound, EU

market analysis

Expectations of interest rate cuts push the sun, and gold and silver bulls hit the track

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. xmniubi.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: Expectations of interest rate cuts push the sun, and gold and silver bulls hit the track." Hope this helps you! The original content is as follows:

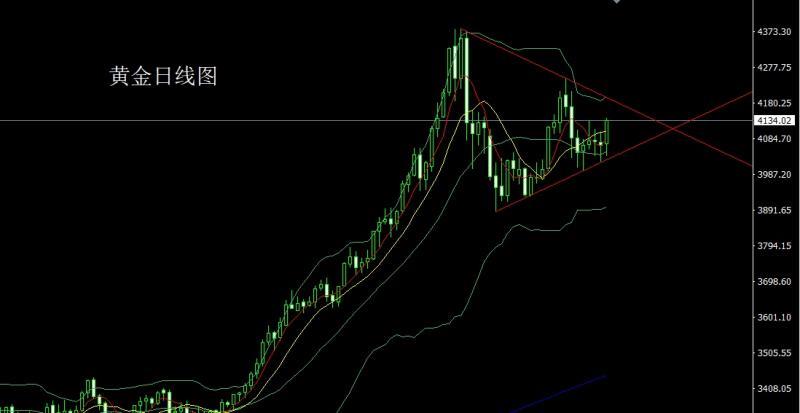

Yesterday, the gold market continued the process of bottoming out and rising last Friday. It opened slightly higher at 4070.8 in early trading and then fell first. After the daily minimum reached 4039.5, the market fluctuated strongly and rose. After the daily line broke Friday's high, the market accelerated its upward trend. The weekly line reached the highest position of 4140.2 and then consolidated. After the weekly line finally closed at 4034, the weekly line closed with a big positive line with a long lower shadow. In this form After the closing, today’s market has continued bullish demand. In terms of points, the longs of 3325 and 3322 below and the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563 will be followed by the stop loss at 3750 after reducing positions. Hold, today it will first fall back to 4105 and more, conservatively 4102 and more stop loss 4097. The target is 4125 and 4140 and 4152 and 4160 and 4170. If the position is broken, the 4180-4190 triangle will be arranged to xmniubi.compete for the pressure on the upper track.

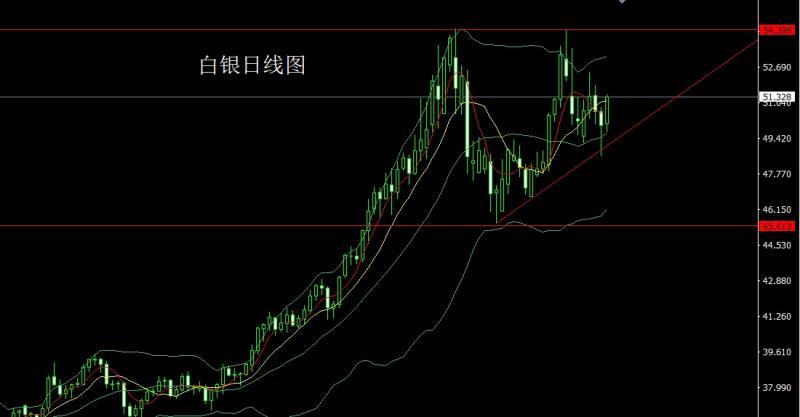

The silver market first fell after opening at 50.082 yesterday. The daily low reached 49.687 and then the market rose strongly. The daily high hit 51.409 and then consolidated. Logically speaking, after the daily line finally closed at 51.328, it closed with a big positive line with a long lower shadow. After finishing in this form, today's market rebounded and continued to be bullish. In terms of points, the bullish line below was 37.8 and the bullish line was 38.8.Follow up and hold at 42, stop loss at 50.55 for today's long 50.75, target 51.3, 51.6 and 52.

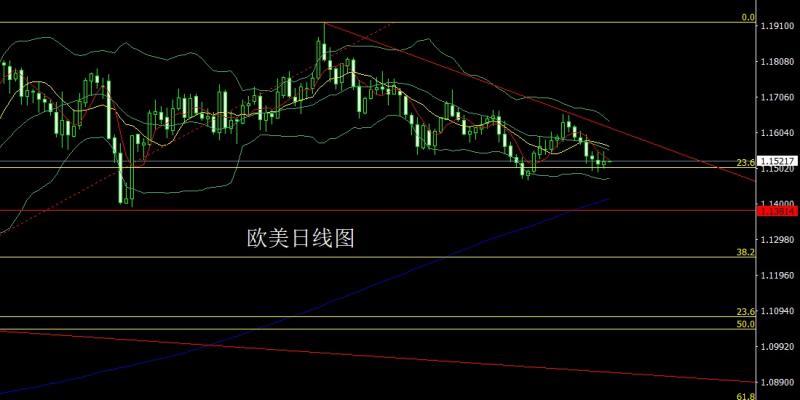

European and American markets opened at 1.15112 yesterday and then the market fell first. The daily low reached the 1.15009 position and then the market rose strongly. The daily high reached 1.15009. After reaching the position of 1.15506, it fell back. The daily line finally closed at the position of 1.15207. After that, the daily line closed in the form of an inverted hammer with a long upper shadow line. After such a form ended, the daily line double Inverted hammer head, today's market is back to short. In terms of points, last week's short position at 1.16050 and yesterday's short position at 1.15950 were reduced, and the stop loss was followed up at 1.15800. Yesterday's short position was at 1.15500. Short exit in early trading, today 1.15500 is still short, stop loss is 1.15700, the target below is 1.15200, 1.15000 and 1.14800.

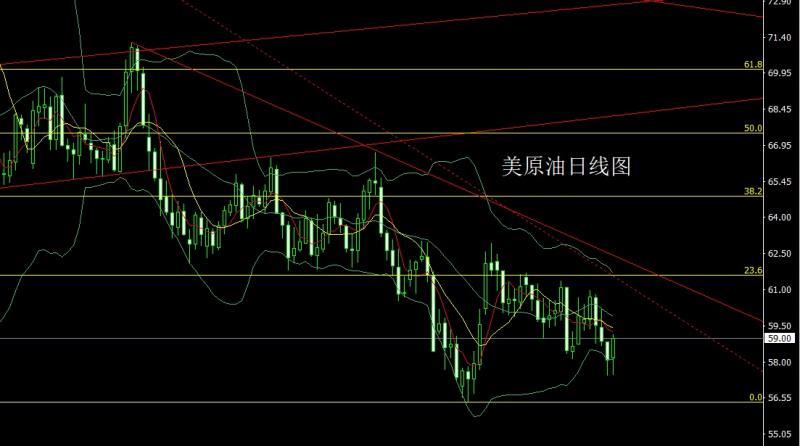

The U.S. crude oil market first fell back after opening at 58.2 yesterday. The daily low reached 57.5 and then the market rose strongly. The daily high touched 59.16 and then consolidated. The daily line finally closed. After the line is at 59, the weekly line closes with a big positive line with a long lower shadow. After the end of this form, the sun is rising and the sun is falling. Today, 58.4 is more than 57.9, and the stop loss is 57.9. The target is 59 and 59.5-60.

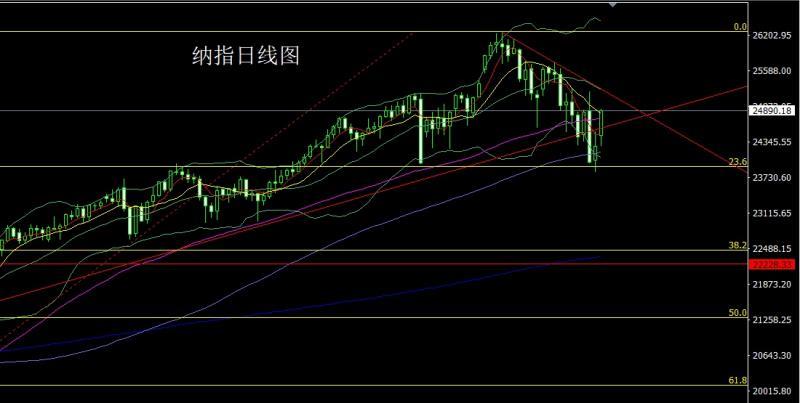

The Nasdaq opened higher yesterday at 24457. After that, the market first fell back to cover the gap and reached a daily low of 24285.76. Then the market rose strongly. The daily line reached a maximum of 24922.96 and then consolidated. After the daily line finally closed at 24890.18, the daily line closed with a big positive line with a long lower shadow. After such a form ended , Today's retracement continues. In terms of points, the stop loss is 24690 for today's 24650, the target is 24800 and 24900, and the breakout is 25000 and 25100.

Fundamentals, yesterday's fundamentals showed that the probability of the Fed cutting interest rates in December rose to 80%, the Nasdaq rose 2.6%, international crude oil rose more than 1.5%, gold rose to 4130 US dollars, and silver rose nearly 3%. Federal Reserve official Le said he was worried about the labor market and advocated cutting interest rates in December. There is a view that the Federal Reserve should wait for the non-farm payrolls release and postpone the December interest rate meeting. Daly expressed support for a December rate cut, citing the fragility of the labor market. Today's fundamentals focus on the monthly US retail sales rate in September and the annual US PPI rate in September at 21:30. Then look at the monthly rate of the US FHFA house price index at 22:00 and the US September S&P/CS 20 large cities have not seasonally adjusted the annual rate of house price index. Later, we will look at the monthly rate of U.S. xmniubi.commercial inventories in August at 23:00, the monthly rate of the U.S. existing home contracted sales index in October, the U.S. Conference Board Consumer Confidence Index in November, and the U.S. Richmond Fed Manufacturing Index in November.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing positions, the stop loss will be followed up and held at 3750. Today, it will first fall back to 4105 and be conservative and stop loss 4102 and 4097. The target will be 4125 and 4140 and 4152 and 4160 and 4170. If the position is broken, the 4180-4190 triangle will be used to consolidate the pressure on the upper track.

Silver: The longs of 37.8 and 38.8 below are followed up and held at 42. Today, the longs of 50.75 and the stop loss are 50.55. The targets are 51.3, 51.6 and 52.

Europe and the United States: The shorts of 1.16050 last week and yesterday The short positions at 1.15950 on the day were reduced and the stop loss was followed up at 1.15800. The short positions at 1.15500 yesterday left the market in early trading. Today, the short positions at 1.15500 are still short and the stop loss is 1.15700. The lower targets are 1.15200, 1.15000 and 1.14. 800.

U.S. crude oil: Stop loss at 58.4 today, stop loss at 57.9, target 59 and 59.5-60.

Nasdaq: Stop loss at 24,690 at 24,650 today, target 24,800 and 24,900, target 2 5000 and 25100.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Expectations of interest rate cuts push the sun, gold and silver bullish on track". It is carefully xmniubi.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here